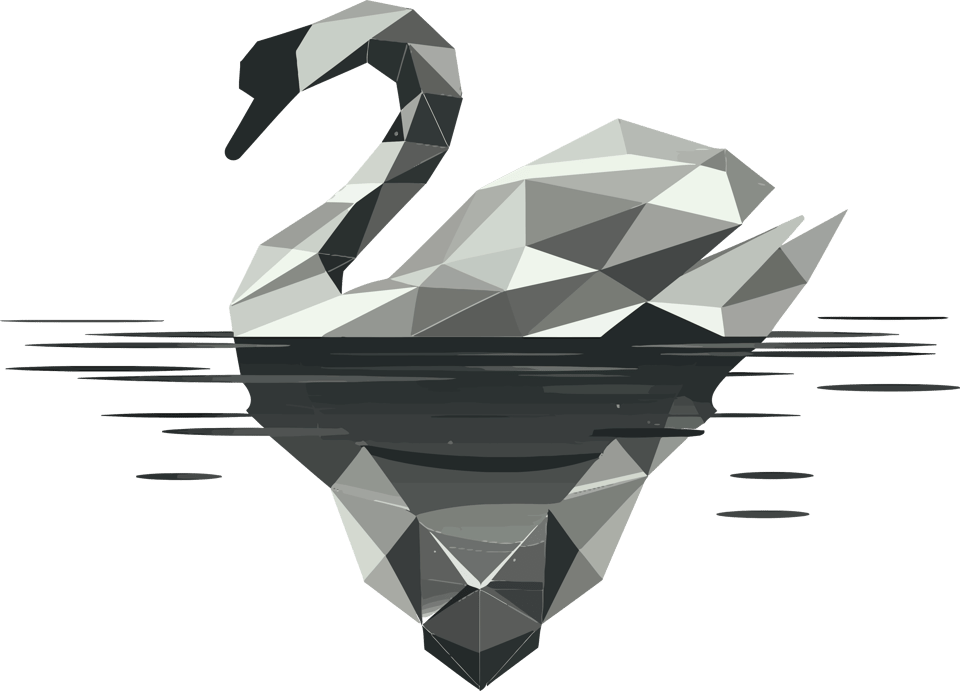

The Bl__k Swan Principle

TL;DR

The Blank Swan Principle posits that many seemingly unpredictable events (often mislabeled as "Black Swans") are actually detectable through careful attention to weak signals and local knowledge, without requiring complex mathematical models. It emphasizes integrating diverse perspectives and taking proactive action based on early warning signs. The principle challenges the notion of true unpredictability in many cases, advocating for a nuanced, multi-faceted approach to risk assessment and event prediction that prioritizes human insight and ground-level observations over centralized or model-heavy approaches.

Wat

Right, so you’ve likely heard about Nassim Nicholas Taleb’s Black Swan (and book of the same name) - a highly improbably event with catastrophic consequences that observers do not see coming. The ‘black swan’ part is based on the belief in 19th century Europe there were no black swans - because they hadn’t seen any yet.

An example of a black swan event is the view of a turkey in the US. It leads a happy life with the friendly farmer feeding it and caring for it every day, leading it to think (this turkey can do such a thing) it’s the most blessed and loved turkey in the world. That all changes on the day before Thanksgiving.

Chaos Kings

I recently finished Chaos Kings: How Wall Street Traders Make Billions in the New Age of Crisis, which is better than it sounds. It’s an account of Taleb and a couple of others who saw and will continue to see gigantic windfalls by betting against the idiocy of late stage capitalism and the associated opinions-dressed-as-science: economics.

It’s a story of people defending themselves against unnecessary risk and winning big by seeing -and heeding- the writing on the wall well in advance of any of the big names that collapsed in various economic crashes.

Dragon Kings

Another character in the book, Didier Sornette asserts that Black Swans are actually Dragon Kings - something that can be detected using complex maths, models and loads of data. He and Taleb are at odds. One thinks there are unforeseeable events you should protect yourself against, the other says these events can be predicted with complex modelling.

Why Not Both?

As I was listening to the book, it got me thinking about detection theory. On one side of the Chaos coin we have Taleb talking about unpredictable events: the fat tails of normal Gaussian distributions and on the other we have Sornette claiming with data and models we’d be able to predict said events. Lo, the Blank Swan was born hatched. Taleb has had various TV appearances attempting to explain that things like the Covid pandemic weren’t Black Swans, but ‘grey’ and it’s become clear to me we humans pay too little attention to weak signals. To illustrate, I’ll lay out a few examples, some of which are likely to be pretty grim, but you’ll get my point.

Weak Signals

Hunger

A person is sitting on their couch at 2330 at night with a full belly and a sad face. They are ‘trying to eat better’ but just pounded a tub of ice cream after a stuffed crust pizza. When we look at their morning, they woke up and had coffee for breakfast. They worked through their lunch because someone somewhere demanded a spreadsheet or report or whatever. They get home exhausted and hadn’t got to shopping for the week yet, so settled into revenge-watching Netflix while ordering from a delivery app. Essentially, they ignored hunger signals until they were so loud any intentions were overridden by a primal demand for high energy availability food ASAP. This isn’t an out-of-nowhere failure of willpower. It’s basic physiology 101. Don’t starve yourself.

Would-be Assassin

A convicted felon who also happens to have run a country and some hotels or golf courses(?) recently narrowly avoided a bullet. News reports were of a quiet kid whose local neighbourhood couldn’t believe he was the perpetrator. Contrast this with an interview of schoolmates saying he was mercilessly bullied daily. This is a weak signal - but who would be the kid trying to talk to him at risk of being outcast themselves? This was a failing of adults. Teachers and parents no doubt knew this was going on, but didn’t bother to do anything about it. Now the kid is dead and an ex-president almost met the same fate. This may have been considered a Black Swan event. Security teams and the community alike “didn’t see it coming” - but the signals were there.

Riots

When the BLM riots erupted after the death of George Floyd, it appeared the US and other countries were in a state of shock - as if this too appeared out of nowhere. I am willing to bet the cops in the precinct knew that maybe the perpetrators of his murder were heavy handed or had some icky opinions but didn’t want to rock the boat so said nothing to nobody. More weak signals going unattended to with catastrophic consequences.

9/11

In By All Means Available: Memoirs of a Life in Intelligence, Special Operations, and Strategy, Michael G Vickers talks about the conclusion of the Russian / Afghan conflict and CIA / Chinese / Pakistani / UK involvement. He admits he and his CIA colleagues were familiar with many of the fundamentalists spouting misaligned opinions who were bankrolling the Mujahidin - especially Osama Bin Laden, all of whom they interacted with at some level, but chose not to heed to early signals saying “That’s that, we won’t need to come back here again.”

Need I say more?

Signal Detection

These events all had detectable signals at a local level, the crux of my Blank Swan Principle. See, you don’t need complex mathematical models and mountains of data to identify something being “off” - you need locality and awareness. Once you’ve identified something isn’t right, you raise the alarm. Doing this permeates through a system. A network of inter-operating localities can propagate relevant information to ensure against collapse. If everyone in the system is aware, their locality to an event will result in essential info getting where it needs to be, locality by locality and likewise false alarms being nipped in the bud.

The Problem with Being Right

There’s an issue with the idea of acting on weak signals though. If you’ve ever opted not to jump a gap, walk down that alley with those dudes next to the bins, drive in that storm - you’ll be painfully aware you have absolutely no evidence it was the correct decision because nothing happened. You have no empirical data saying it was the right thing to do. This means following intuition (not assumption*) - acting early on weak signals to avert potentially global disasters all have no proof it was the correct thing to do making it hard to be sure you weren’t just being silly.

Inflection Point

Not to get philosophical, but I genuinely feel as though the world is at an awareness horizon. Anywhere I look I now see holistic approaches and inter-disciplinary discussion on novel solutions for current and burgeoning problems from diverse voices. We’re beginning to catch up with the 2500 year old Heraclitean idea that “everything flows” and “change is constant”. Part of this is understanding we’re in a complex adaptive system and linearity should be chained to the recent past, where it belongs**. The Blank Swan Principle is well suited to observing the world as a complex network rather than a milk carton of beliefs.

Of Kings and Swans

So between Taleb’s sudden Black Swans and Sornette’s modeled Dragon Kings lives our Blank Swan. Here we pay attention to local signals and act early enough to ensure a dropped match doesn’t become a forest fire.

Think back to the image of that multi-faceted swan chilling on calm waters with an iceberg beneath.

Let’s reframe risk as the possibility of personal insult or embarrassment rather than environmental collapse or large scale disaster - because our local avoidance of the former could well lead in a way we can never predict to the latter.

/EOF

Lore for Today

*there’s a big difference between assumption and intuition. I’d hazard to suggest assumption is cognitive post-processing and influenced by bias, where intuition is more felt, then articulated rather than computed, then articulated.

**dumbest thing humans ever did to themselves was start thinking in a line

Black Swan, Chaos Kings and By All Means Available are all books I highly recommend.